Financial Services

Enhance your financial risk controls in the telecom industry and discover RiskShield's secure and seamless financial services experience.

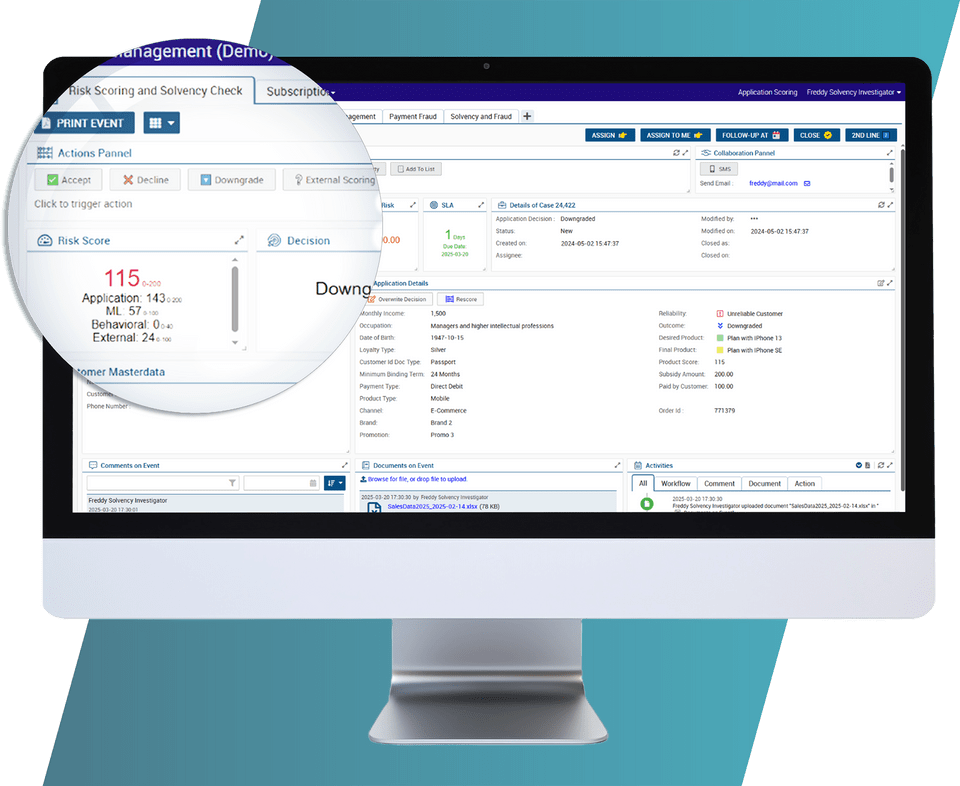

RiskShield supports credit risk scoring by assessing customer risk in real time, reducing financial losses, and enabling accurate credit decisions across the customer lifecycle. It helps balance risk and growth by optimizing approvals and minimizing bad debt during onboarding and customer applications.

Trusted by industry leaders

Join our prestigious customers – trusted names in telecom.

REAL-TIME CREDIT RISK ASSESSMENT

OPTIMIZED APPROVALS WITH CONTROLLED RISK

REDUCED BAD DEBT AND FINANCIAL LOSSES

OPERATIONAL EFFICIENCY AT SCALE

Effective credit risk scoring in telecom goes beyond fast decisions. RiskShield provides the transparency, control, and analytical depth needed to manage credit risk consistently across onboarding, portfolios, and ongoing customer relationships.

RiskShield for Credit Risk Scoring supports telecom providers in balancing risk and growth by enabling real-time credit risk assessment during onboarding and customer applications. It helps reduce bad debt, optimize approval rates, and improve credit decision accuracy without adding operational complexity.

Download our dedicated paper to learn how RiskShield Credit Risk Scoring supports scalable, data-driven credit decisions across the customer lifecycle.

One of Switzerland’s leading telecommunications providers, Sunrise Communications AG, has selected RiskShield’s cloud-based Credit Risk Scoring to balance customer acquisition with controlled credit risk. By leveraging real-time credit risk evaluation and optimized risk management processes, Sunrise improves the accuracy of credit decisions while reducing bad debt.

With RiskShield, Sunrise benefits from:

Looking for a live demo or want to discuss your credit risk strategy? Fill in your details below and we’ll be in touch shortly.

Ana Miranda

Business Development Manager | Risk & Fraud

Ana Miranda is a Business Development Manager for Telecommunications in the Risk & Fraud division of INFORM. INFORM's intelligent, cutting-edge RiskShield software empowers telecommunication companies to mitigate the risk of fraud, bad debt, and customer churn by leveraging all data available using real-time Hybrid AI technologies. Having worked for some of the leading telecom operators' risk divisions in Europe, Ana prides herself with an extensive experience in Fraud Management, Revenue Assurance and Risk Management.