Claims Fraud Detection in Real Time – Hybrid AI for Smarter, Faster Decisions

Discover in our paper how RiskShield detects insurance fraud in real time with Hybrid AI. Stop fraud faster and protect margins with explainable automation.

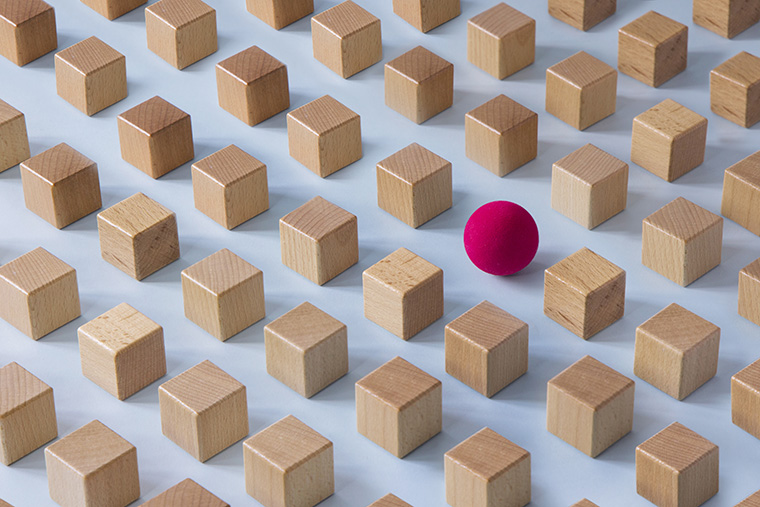

RiskShield enables insurers to detect and prevent fraudulent claims in real time by using a Hybrid AI approach that combines rule-based logic with machine learning to accelerate claims handling, reduce false positives, and empower teams with full transparency and control.

Trusted by Industry Leaders

Join our prestigious customers – trusted names in the insurance sector.

RiskShield combines rule-based logic, machine learning, and automation to detect and prevent claims fraud in real time, ensuring accuracy, transparency, and operational efficiency across the insurance lifecycle.

1. Hybrid AI Scoring

Combines expert rules and machine learning to deliver accurate, real-time claim scoring and fraud probability assessments.

2. Explainable Decisions

Ensures full transparency with auditable logic, traceable decision paths, and clear reasoning for every automated action.

3. Automation at Scale

Accelerates workflows through automated case handling, routing, and payout management, minimizing manual effort and delays.

4. Connected Insights

Links claim data, entities, and behavioral patterns across portfolios to uncover hidden relationships and prevent repeat fraud.

With RiskShield, claims fraud detection becomes faster, smarter, and more transparent – helping you protect margins and customer confidence.

After just a few weeks of use, RiskShield achieved a threefold increase in fraud detection – from 1 % to 3.6 %, even with minimal input data and no external sources. This demonstrates the power of RiskShield’s AI-driven scoring to deliver reliable results from day one.”

Fraud detection in insurance claims involves multiple teams working with different data sources and priorities. RiskShield streamlines collaboration across departments by providing real-time insights, automated scoring, and explainable decisions, empowering every team member to identify and manage fraud efficiently.

RiskShield for Claims Fraud Detection empowers insurers to identify suspicious claims early, reduce false positives, and accelerate claims handling.

With real-time analytics and explainable AI, RiskShield detects hidden fraud patterns across channels and ensures fast, transparent decisions that protect both customers and profitability.

Download our dedicated brochure for more insights.

Find more interesting info papers, brochures, and other downloadable assets on RiskShield in our section Expertise.

Let’s talk about how RiskShield helps you automate investigations, improve detection accuracy, and deliver faster, more transparent claims processing.

Oliver Walczak

Team Lead Insurance Solutions | Risk & Fraud

Oliver Walczak combines a strong technical background in communication and media engineering with extensive experience in risk and fraud management. After an apprenticeship in communication electronics and an engineering degree, he spent eight years leading application development in traffic telematics and incident prevention. He has since worked for over 13 years as a business consultant and team lead in the Risk & Fraud area. Today, he leads the Insurance Solution Stream at INFORM.