May 17, 2017 Matthew Wittemeier

ShareReviewing the notes from four terminal conferences, held on three continents, all during the month of April, one cannot help but see the convergence of the industry, globally, on a single major theme: automation. But why now? Automation has been around for over two decades with very low market saturation achieved. In a two part article, as a wrap up for the German American Chamber of Commerce’s Business Conference, World Port Development's Port and Terminal Technology Conference, Port Technolgy International's Container Terminal Automation Conference, and TOC Asia 2017, we’ll explore automation (part 1) and have a look at other advanced technology and the future of terminal management (part 2).

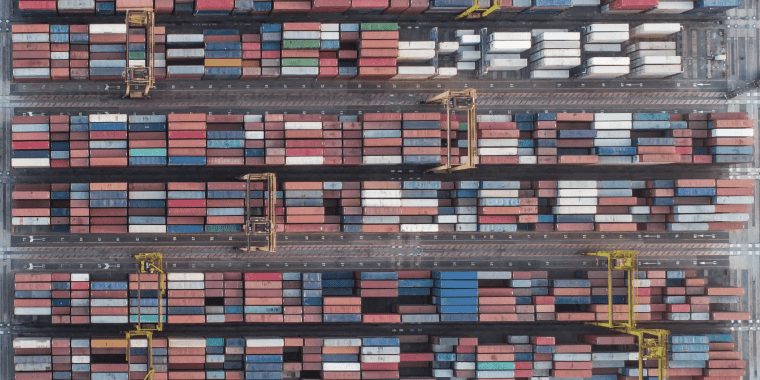

Automation

At the PTI Conference, it was estimated that only 3% of maritime terminals are fully automated, with a further 7-13% partially automated - so at best, 16% of terminals have made real investments in automation technologies. This number is staggering low for a technology that made its debut in 1993 at Rotterdam's ECT's Delta/Sea-Land Terminal (now the Delta Dedicated North Terminal). Why? Many of the early adopters of terminal automation technologies faced, and are still facing, challenges of reaping the full benefits of those investments. This is in part due to the nature of new technology projects as well as the social aspects of automation. While we'll explore these ideas in greater detail in an upcoming post on the challenges of automation, this article aims to explore why automation is coming into sharp focus now.

Shipping companies are driving automation.

It has been said that as terminals continue to grow to accommodate bigger ships, terminal automation inevitably follows; and terminals certainly have grown. As of 2016, twenty of the world's largest ports were capable of serving 20,000 TEU mega ships. It is no surprise to see automated ports like Rotterdam on that list. Failing to expand and accommodate vessels in this class creates concerns from ports regarding their ability to compete in the future. However, the infrastructure and equipment required to unload and load mega ships in a timely fashion is astonishing. Without quick port turnarounds, mega ships are left sitting unproductive, something that their owners don’t want. Ports are feeling the pressure from shipping companies to be as efficient as possible with these mega ships, hence the recent regeneration of interest in automation.

Financial benefits are driving automation.

Automation promises to deliver unmatched productivity. It also promises to do so at a lower cost compared to conventional systems. The investment costs are measured in the hundreds of millions of dollars, and implementation at brownfield terminals is challenging at best. Despite these challenges, ports around the world are building strong ROI arguments that justify these complex projects.

Flexibility to market conditions is driving automation.

A final important factor to consider around automation is the cost of market downturns and the flexibility needed to effectively respond to them. As the shipping industry cycles through its natural peaks and troughs, the flow on effect to container terminals can't be ignored. That said, the case for automation can be argued against and for during downturn periods. It might go something like this:

Arguments Against Automation - volumes are low; we can't justify the spending. Or, the increased OPEX costs of new equipment detracts from our ability to remain flexible in all market conditions.

Arguments For Automation - we should invest now, while we have the time and space to upgrade our terminals. Or, automation will decrease OPEX costs through a reduction of vehicles and improve our ability to weather future troughs.

Either way, OPEX can be spun to fit the situation at hand. What we've seen is that container terminals are strongly debating, planning, and implementing automation technology projects at their terminals and will continue to do so moving forward. Next week, in part 2, we’ll take a broader look at other topics like mega ships, transshipment hubs, Hyperloop One, and why Airbnb and Uber are on the minds of terminal operators.

What is the role of automation in ports moving forward into the future? Are you a terminal operator and NOT considering automation? If so, why?

About our Expert

Matthew Wittemeier

Matthew Wittemeier is the Director of Strategy for INFORM ANZ, having previously served as Director of Marketing and Strategy for INFORM’s Terminal & Distribution Center Logistics Division. In this role, he became a thought-provoking contributor to many industry publications and conferences. He’s also co-author of the award-winning 2038: A Smart Port Story—a story about the future of technology and the social challenges it may bring.