Apr 29, 2025 // Hannah Kuck

Instant Payments and Risk Management: Three Departments Caught Between Regulation and Real-Time Pressure

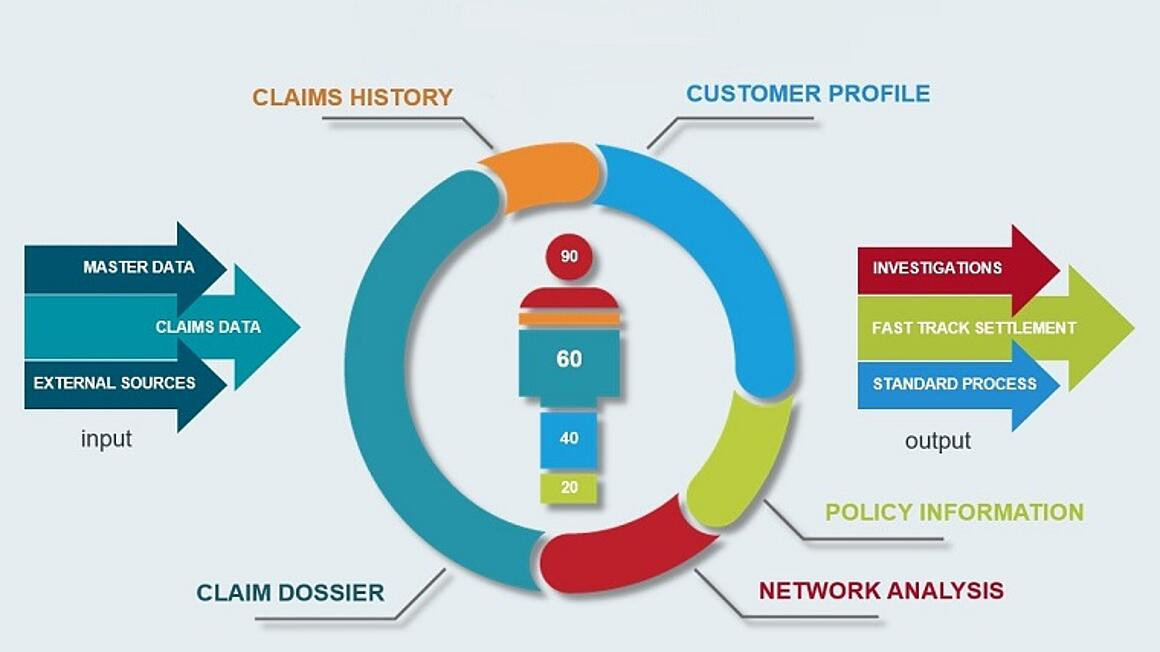

Instant payments demand real-time fraud prevention - how can risk, compliance, and sanction experts keep up with the pressure and regulation?