Survey on yard management at industrial companies

108 specialists and executives provide insights: What are currently the biggest challenges in yard management, what role do digital solutions play, and which technologies will be crucial in the future?

Study participants

108 specialists and

managers

from logistics, industry, and trade

Mostly German companies

Part of the results

In German factory yards, things rarely go according to plan. Between arriving trucks, scarce resources, and tight time frames, every day is a struggle to keep operations running smoothly. Yard management plays a key role in this. It ensures that delivery, storage, production, and shipping are coordinated and that material flows remain on track. However, this area in particular is under pressure in many places, as supply chains are becoming more complex and expectations for transparency and efficiency are constantly growing.

Punctuality remains the exception

The current survey shows how this plays out in practice. Around 29 percent of respondents report that less than one in ten trucks arrive at their scheduled time. For another 25 percent, delays occur in up to a quarter of all transports, and 19 percent experience them in around half of all deliveries. The situation is particularly challenging for 14 percent of companies, where more than half of all trucks arrive late. Not a single respondent stated that deliveries are always on time.

There are many reasons for this: 66 percent cite unexpected events or disruptions in the process that can quickly trigger chain reactions. 64 percent point to bottlenecks in internal resources, such as personnel or technology, which further slow down processes. Uncoordinated truck arrivals are cited by 54 percent, inaccurately planned or missing time slots by 37 percent, and overloaded loading points by 35 percent. And sometimes it simply fails in practice: QR code check-ins that don't work, missing notifications, or customs formalities cause additional work, especially in international transport, as individual respondents report.

Full yards, tight time slots

A glance at the transport volume shows just how great the logistical effort is on a daily basis: around 39 percent of the companies surveyed record between 51 and 100 truck arrivals every day. Around 35 percent receive up to 50 vehicles per day, while 10 percent handle between 101 and 200 deliveries. For 16 percent, the figure is even higher than 200 trucks per day. The pace is correspondingly high: for more than half (53 percent), it takes between one and two hours to process a truck. Just under 29 percent manage to process vehicles within an hour. For around 6 percent, the process takes between two and three hours, and another 9 percent need more than three hours to get the vehicles back on the road.

Given these dimensions, it is clear that anyone who maneuvers dozens or even hundreds of trucks across the yard every day needs more than just good timing. Many companies therefore rely on digital support to make processes more transparent, predictable, and efficient. Around 59 percent of those surveyed already actively use yard management software, with a further six percent in the implementation phase. Despite the trend toward digitalization, 24 percent still lack the necessary functionality, and 11 percent currently see no need for it in their company. The reasons for this are a lack of internal capacity (48 percent), difficulties in integrating it into existing IT systems (27 percent), and organizational hurdles in coordinating with carriers or partners (25 percent). Resistance to change management also plays a role for 25 percent. Other reasons include unclear benefits (18 percent), existing processes that work well (16 percent), and budget constraints (14 percent). Some respondents also cite industry-specific causes such as a lack of infrastructure or restrictive customer processes.

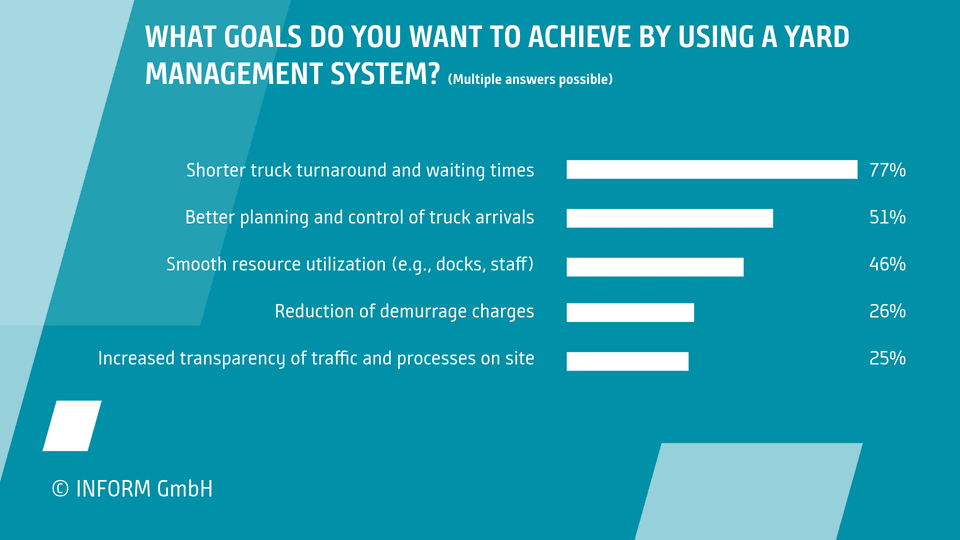

Efficiency and transparency as key objectives

The goals that companies associate with the use of a yard management system are primarily aimed at greater efficiency and transparency. Three-quarters of those surveyed (77 percent) want to use such a system primarily to reduce throughput and waiting times. Around half (51 percent) are aiming for more precise control of truck traffic, and 46 percent want to achieve a more even utilization of personnel and docks. Around a quarter of companies associate digital systems with the goal of reducing demurrage charges (26 percent) or creating greater transparency regarding traffic and processes on site (25 percent).

When it comes to the requirements for modern yard management systems, the focus is clearly on automation. 60 percent of those surveyed would like to see processes run largely independently in the future, thereby becoming more efficient. Driver involvement also plays a major role: 63 percent value self-check-in functions, while 56 percent value mobile applications for independent management of arrivals and processes. Transparency and networking are equally important. Fifty-five percent want evaluation and reporting tools, and 53 percent want the ability to respond quickly to deviations from the plan. Around one-third also consider the connection of hardware such as barriers, traffic lights, or sensors to be essential, while around one-quarter consider interfaces to telematics, time slot, or trailer systems to be necessary in order to seamlessly link data flows.

The increasing use of intelligent control systems, digital systems, self-check-ins, and mobile applications shows that yard management has long been considered strategically and that its benefits are becoming increasingly recognized.

Looking ahead: AI, cloud, and real-time data

What will yard management look like in the future? For most companies, the answer is: smarter, more connected, and easier to use. Mobile and intuitive usability is the top priority, with 61 percent of respondents considering it a must so that drivers, dispatchers, and plant security can all work with the system with equal ease. Almost half also expect deep integration with existing ERP, warehouse, or transport systems (49 percent) and real-time tracking via IoT and telematics solutions (46 percent). Forty-five percent see AI-based process optimization as a decisive step toward greater efficiency. One-third (31 percent) emphasize the importance of cloud-based, scalable architectures that ensure flexibility and future-proofing. The technological basis is also changing: 40 percent of companies already use cloud solutions, and 52 percent are open to using them.

“The results show how sensitive yard management processes are to even the smallest deviations,” summarizes Oliver Graf, SYNCROSUPPLY Product Manager at INFORM. "If a truck arrives late, this often triggers a whole chain of knock-on effects, from waiting times at the ramp to bottlenecks in production or delays in guaranteed delivery dates. At the same time, however, there is also a positive trend: many companies are no longer accepting these weaknesses, but are actively taking steps to counteract them. The increasing use of intelligent control systems, digital systems, self-check-ins, and mobile applications shows that yard management has long been considered a strategic issue and that its benefits are increasingly being recognized. Particularly exciting is the development toward intelligently networked solutions with interfaces to ERP, IoT, and telematics, cloud-based architectures, and, increasingly, AI-supported optimizations. Those who create the right structures early on will lay the foundation for a more resilient and efficient supply chain," says Graf.

U.S. Yard Management Study now open!

INFORM is currently conducting a U.S. edition of the Yard Management Trend Report to explore how yard management differs between Europe and North America. The study aims to compare challenges, strategies, and technology adoption across regions.

If you’re based in North America and would like to contribute your insights, we invite you to take part in the survey and help shape the upcoming Yard Management Trends Report.